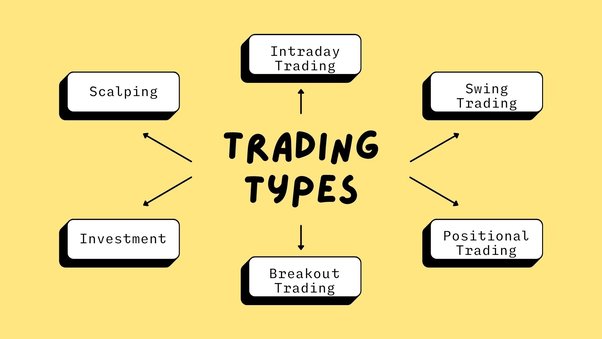

Trading is challenging and requires perseverance and discipline. While there are many ways to trade – intraday, short-term, and long-term trading are the most common types. Traders often need clarification about which type of share trading fits them, as they all have unique benefits and shortcomings.

The many share trading options and what each one entails will be covered in this article. We will also discuss each strategy’s benefits and drawbacks.

Day trading

Buying and selling securities, like shares, currencies, options, etc., within a day, is referred to as intraday or day trading.

Even if traders do not execute them, all trades are automatically squared off before the market’s closing.

Intraday trading is the most popular type as it is more liquid and has a higher volume than short-term or long-term trading.

Day trading necessitates constant observation of the stock prices and fluctuations, as well as timing the entry and exit of trades.

Pros

Some of the pros of intraday trading are:

- One of the pros of intraday trading is that it allows traders to take advantage of short-term price movements and react to changes in the market quickly.

- The main advantage of intraday trading is that it does not carry overnight risk, i.e., traders do not have to carry forward their trade for the next day.

Cons

Some of the cons of intraday trading are:

- A day trader has to monitor the market continuously; one fault can cause capital loss.

- A day trader executes several deals. They are required to pay brokerage each time they trade. They must pay the brokers’ brokerage even if they incur losses.

Short-term trading

Short-term traders are those who trade in stocks that are held for a few days to weeks. In this case, the trader profits from the market’s quick price changes and volatility.

This is the best course of action for a novice investor in the stock market. However, beginners must have a trading account to start trading in the share ma

Trading is challenging and requires perseverance and discipline. While there are many ways to trade – intraday, short-term, and long-term trading are the most common types. Traders often need clarification about which type of share trading fits them, as they all have unique benefits and shortcomings.

The many share trading options and what each one entails will be covered in this article. We will also discuss each strategy’s benefits and drawbacks.

Day trading

Buying and selling securities, like shares, currencies, options, etc., within a day, is referred to as intraday or day trading.

Even if traders do not execute them, all trades are automatically squared off before the market’s closing.

Intraday trading is the most popular type as it is more liquid and has a higher volume than short-term or long-term trading.

Day trading necessitates constant observation of the stock prices and fluctuations, as well as timing the entry and exit of trades.

Pros

Some of the pros of intraday trading are:

One of the pros of intraday trading is that it allows traders to take advantage of short-term price movements and react to changes in the market quickly.

The main advantage of intraday trading is that it does not carry overnight risk, i.e., traders do not have to carry forward their trade for the next day.

Cons

Some of the cons of intraday trading are:

A day trader has to monitor the market continuously; one fault can cause capital loss.

A day trader executes several deals. They are required to pay brokerage each time they trade. They must pay the brokers’ brokerage even if they incur losses.

Short-term trading

Short-term traders are those who trade in stocks that are held for a few days to weeks. In this case, the trader profits from the market’s quick price changes and volatility.

This is the best course of action for a novice investor in the stock market. However, beginners must have a trading account to start trading in the share market.

Pros

Some of the pros of short-term trading are:

In contrast to long-term trading, which calls for a significant financial investment, short-term trading utilises less money.

It is easier to plan exit and entry under this trading strategy as traders have a longer time horizon.

Cons

Some of the cons of short-term trading are:

Trading in the short term requires a lot of focus. Purchasing and selling decisions require constant market monitoring.

Finding out where the stock/market is going may be quite unexpected, putting traders in a stressful scenario. Moreover, the markets can be more volatile, leading to more losses.

Long-term trading

Long-term trading is an investment strategy that involves holding onto assets for extended periods to reap the maximum rewards. Here, traders are not interested in benefiting from short-term market movements.

The main advantages of long-term trading are that it allows one to weather market volatility, enjoy the benefit of compounding returns, and take advantage of lower transaction costs.

Usually, traders utilise fundamental analysis to identify stocks to buy and sell.

Pros

Some of the pros are:

Long-term traders can weather market volatility, which is one of their key advantages.

Long-term trading involves less cost as there are very few transactions involved.

Cons

Some of the cons are:

The main disadvantage of long-term trading is that it can take a long time to see profits. This can be frustrating for traders.

In long-term trading, traders have to block their money for a long-time.

Conclusion

Intraday trading is preferable if one wants to quickly make money.

Short-term trading is a good option if traders want to make moderate profits over a short period. Moreover, long-term trading is the best choice if traders want to build wealth over the long term.

However, it all depends upon your investment goals, the risk you are willing to take, and what you expect from trading.

rket.

Pros

Some of the pros of short-term trading are:

- In contrast to long-term trading, which calls for a significant financial investment, short-term trading utilises less money.

- It is easier to plan exit and entry under this trading strategy as traders have a longer time horizon.

Cons

Some of the cons of short-term trading are:

- Trading in the short term requires a lot of focus. Purchasing and selling decisions require constant market monitoring.

- Finding out where the stock/market is going may be quite unexpected, putting traders in a stressful scenario. Moreover, the markets can be more volatile, leading to more losses.

Long-term trading

Long-term trading is an investment strategy that involves holding onto assets for extended periods to reap the maximum rewards. Here, traders are not interested in benefiting from short-term market movements.

The main advantages of long-term trading are that it allows one to weather market volatility, enjoy the benefit of compounding returns, and take advantage of lower transaction costs.

Usually, traders utilise fundamental analysis to identify stocks to buy and sell.

Pros

Some of the pros are:

- Long-term traders can weather market volatility, which is one of their key advantages.

- Long-term trading involves less cost as there are very few transactions involved.

Cons

Some of the cons are:

- The main disadvantage of long-term trading is that it can take a long time to see profits. This can be frustrating for traders.

- In long-term trading, traders have to block their money for a long-time.

Conclusion

Intraday trading is preferable if one wants to quickly make money.

Short-term trading is a good option if traders want to make moderate profits over a short period. Moreover, long-term trading is the best choice if traders want to build wealth over the long term.

However, it all depends upon your investment goals, the risk you are willing to take, and what you expect from trading.